This one’s all about the dolla billz, baby! Many creative entrepreneurs get emotional when it comes to price increases. So, what if there were an easy, external way to know that it’s time to raise your rates?

What if there were 11 ways?

Your wish is my command! Here are 11 external indicators that can help you determine if the time is right for a price increase in your creative business.

Need help communicating that price increase? Consider joining us for the Creative Freedom Guide To Overcoming Underearning, and build your confidence in changing your pricing!

What do you struggle with when it comes to raising your rates?

Share your thoughts and ideas in the comments. Your insights may spark a conversation that helps someone else!

Share your thoughts and ideas in the comments. Your insights may spark a conversation that helps someone else!

Mentioned in this episode:

Rising Tide Members

If you haven't already downloaded this week's bonus content, you'll want to do that here. Not a member yet? It's free! When you register for email updates, you also get access to episode transcripts, worksheets, and other downloadables!

Credits and Sponsors

Fashion jewelry from Kerianne at FancyBargain.com. Tell her you saw her bling on Creative Freedom!

Music: "Welcome to the Show" by Kevin MacLeod

Licensed under Creative Commons: By Attribution 3.0

It's been a busy month at Creative Freedom HQ! As the first quarter of the year heads into the sunset, I've been plastering my face and voice all over everyone else's website this month in preparation next month's big open enrollment for the Creative Freedom Incubator. If you know you need both coaching and hands-on help in your business, think about applying now to beat the rush. For a limited time, I'm waiving the application fee, so don't dilly dally!

I had the joy of being featured in 4 different places this month. Please check 'em out, leave a comment, and let the hosts know that you'd like them to bring me back! It's your comments, feedback, and recommendations that help me spread the Creative Freedom message far and wide!

Profit. Power. Pursuit. podcast

Host Tara Gentile and I sat down to talk in-depth about the Creative Freedom Incubator - what it is, how it works, and more importantly, WHY it works. Designed for creatives in Early Struggle, the Incubator combines coaching with crucial hands-on business support (VA/Marketing/Admin) that most early-stage businesses need, but can't afford.

Host Tara Gentile and I sat down to talk in-depth about the Creative Freedom Incubator - what it is, how it works, and more importantly, WHY it works. Designed for creatives in Early Struggle, the Incubator combines coaching with crucial hands-on business support (VA/Marketing/Admin) that most early-stage businesses need, but can't afford.

We go behind the scenes in how the whole concept was developed, how it evolved, the tough lessons I learned in the first year, and how I've adapted the program to better fit (and inform) my business model. I also talk about what didn't work, client results, and how I've set things up for more success (for them and myself) going forward.

Profit. Power. Pursuit. podcast: Offering a Service at “Pay For Results” Pricing

Profit First podcast

This is my second appearance on Mike Michalowicz's popular show. He's a funny guy, and his co-hosts keep things hopping. Mike's the guy who wrote The Toilet Paper Entrepreneur, The Pumpkin Plan, Surge, and, yes, Profit First. His new book, Clockwork will be out this fall.

This is my second appearance on Mike Michalowicz's popular show. He's a funny guy, and his co-hosts keep things hopping. Mike's the guy who wrote The Toilet Paper Entrepreneur, The Pumpkin Plan, Surge, and, yes, Profit First. His new book, Clockwork will be out this fall.

This time around, we're talking about Growth Plans and my book, Creative Freedom: How To Own Your Dreams Without Selling Your Soul. We also talk about the Creative Freedom Entrepreneur Type Spectrum, as well as how I was able to sell copies of my album for upwards of $40 per song. If you're a performing or fine artist, you'll definitely want to check it out for ideas on building relationships with your audience.

Profit First podcast: How To Own Your Dreams Without Selling Your Soul

The Strategy Hour podcast

This was my first (and hopefully NOT last) appearance on The Strategy Hour with Abagail and Emylee. These two are a powerhouse combination of business smarts and compassion for the creative entrepreneur's lifestyle. We talk about the importance of striving for a six-figure business - or not, and the rare reasons why you may not need to aim that high. We also dig into the Cusp types - something I don't get to do very often when talking about the Creative Entrepreneur Type Spectrum. If you're a cuspy, this could be some great learning for you.

This was my first (and hopefully NOT last) appearance on The Strategy Hour with Abagail and Emylee. These two are a powerhouse combination of business smarts and compassion for the creative entrepreneur's lifestyle. We talk about the importance of striving for a six-figure business - or not, and the rare reasons why you may not need to aim that high. We also dig into the Cusp types - something I don't get to do very often when talking about the Creative Entrepreneur Type Spectrum. If you're a cuspy, this could be some great learning for you.

The Strategy Hour podcast: The Problem You Have with Reaching 6 Figures

Productive Flourishing

I love me some Charlie Gilkey! I was lucky enough to be a guest just as the Creative Freedom Spectrum was coming into the world, so when they asked me back as a contributor, I was thrilled!

I love me some Charlie Gilkey! I was lucky enough to be a guest just as the Creative Freedom Spectrum was coming into the world, so when they asked me back as a contributor, I was thrilled!

On the heels of Oprah's Golden Globes speech, this post provides some insights for people wanting to speak their truth with their audience in ways that won't alienate their true fans, while still being a genuine reflection of their thoughts, values, and beliefs.

Productive Flourishing blog: 5 Things You Need To Know To Speak Your Truth And Connect With Your Audience

Yep, it's been a pretty busy month for me, and I wouldn't trade it for the world. But we've also got some big happenings coming up around here, too. The new season of Creative Freedom is right around the corner, and I can't wait to share the new episodes with you!

Again, Please take a moment to check out the content that interested you, leave a comment or review, and let the hosts know that you'd like them to bring me back! Your comments, feedback, and recommendations are an important part of making sure I get to be a repeat guest. And if you know some podcast or stage I should be speaking on, let us know! I'd really like to see more people this year and get Creative Freedom into as many hands as possible!

[Note: This is an excerpt from my book "Creative Freedom: A comprehensive guide to personal and financial freedom as a creative entrepreneur". If you'd like to be the first to get updates and excerpts, make sure you're on my mailing list, so you don't miss a beat!]

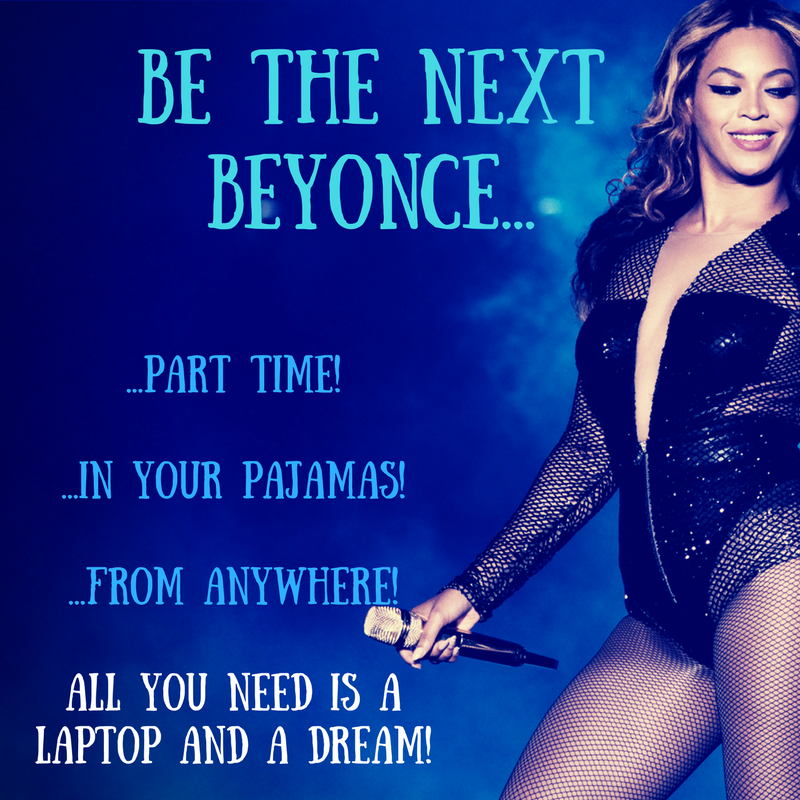

Suppose you saw this "advertisement" on social media. You'd no doubt roll your eyes, scratch your head, and maybe even wonder aloud "Who do they think they are? Beyonce is like The Highlander... there can be only one!"

The Highlander franchise might belie that notion, but I digress.

Regardless, you'd likely consider this ad complete nonsense and skip right on past - no matter how badly you'd like to be the next Queen Bey.

And yet, how many times have you been lured by other similar, yet equally absurd promises?

Depending on the circles in which you travel, you may have mixed emotions about the phrase "earn six-figures a year." After all, earning six or seven figures is the holy grail of many online business coaches and so-called internet marketing gurus.

The phrase "earn six-figures" is often followed by such deceptive codswallop as "in your sleep" or "in your pajamas" or "part time from anywhere".

These inflated promises are often found co-mingling with sentences like "all you need is a laptop and a dream."

Puh-lease.

While it's true that some people have done those things, the reality is that very few people can replicate their success - and when they do, success doesn't happen overnight. There's no "blueprint" or "formula" that's going to give you those kinds of results overnight.

I regularly write about the fact that those kinds of results take time. Jeff Walker, developer of Product Launch Formula, said he got fewer than 10 buyers the first time he launched. He had to launch more than once before he hit seven figures. Beyonce only became Beyonce after years of focused effort, a few heartaches, and more focused effort.

The same is true about building your own Noble Empire. You have to keep showing up consistently, iterating, focusing on what works and discarding the rest. That's how you build a reputation and make a good living doing what you love.

But too many creatives settle for subsistence-level income in their so-called business. It's time to stop the madness. (Tweet this)

That's why I am a firm believer that every creative entrepreneur needs (yes, I said needs) to build a six-figure company. I call it the Six-Figure Imperative.

The Six-Figure Imperative Explained

At its core, The Six-Figure Imperative is both a mathematical equation and psychological illustration (Fusion creatives, rejoice!). In most casts, a healthy company needs to make at least six figures in order to pay the owner a living wage and still be able to cover the business expenses. Sure, there are places in the world where you can live on less (or might need more), but that's a fair baseline for most creatives, and I don't know many people aiming to live closer to the poverty level - which, in the US, is just over $20,400 for a family of 3 (higher in Alaska & Hawaii).

All you Chaotics out there, breathe a minute and let's explore these numbers. If you want to pay yourself $50,000 per year (before taxes), your company needs to bring in at least $100,000. That's based on the Profit First approach that I use with all my clients. Developed by Mike Michalowicz, the Profit First approach recommends that owner's pay be half of the company income.

So, $50,000 x 2 = $100,000 business revenue

Special notes: Once your business revenue is over $250,000, your owner pay percentage will shrink, and your profit sharing percentage will grow. If you want your take home pay to be $50,000, you'll need to add your taxes on top of that number before you multiply. I'm no tax pro, so you'll have to do that math on your own, but this gives you a baseline idea of how it works.

Now, all you Linears can sit back for a minute while we cover the psychological illustration. Most creatives see the six figure mark in one of two ways:

- They reel against it because of all the icky marketing tactics they've experienced in pursuit of it. "Screw this! 'Six figures' is just a marketing ploy the gurus use to separate you from your money!"

- They drool over it like it's some pie-in-the-sky fantasy that is only available to the likes of Beyonce. "Someday, I'll get discovered, the world will beat a path to my door, and I'll be rolling in the dough!"

The Six Figure Imperative works to break that psychological block by showing you that six figures is not only reasonable, it's important to the long-term health of any full-fledged business.

There's a wide range between six figures and seven figures

When I say "six figures" I mean it as a baseline. I hope you're able to make as much money as you desire with your Noble Empire. Eight figures? Go for it. Ten? Why not? More? That's okay by me, too. But for most of us, the low-end of six figures is a useful rule of thumb.

But there's a big gap between $100,000 and a million. Where should your personal baseline be?

If you're living in a major metropolitan area, where rent is obscene, the low end of six figures might not even cover your mortgage. I saw an apartment listed in Nashville for $8,000 per month. And a girl's gotta eat, right? So your six-figure baseline might be closer to $250,000. That puts you owner pay at $125,000 per year. $96k for rent and $31k for all your other living expenses.

Only you can discern what will really work for you. Maybe you have no kids, or maybe you have seven. Maybe you have no debt, or maybe you've got thousands of dollars in student loans that still need to be paid off. Once you determine your living wage, you'll be able to determine the baseline income goal for your personal Six-Figure Imperative (and also helps you make the six-figure distinction).

Six-figures for a business (not a hobby)

There's one last clarification I need to make. The Six-Figure Imperative applies to full-fledged businesses. If you're a creative entrepreneur with a "side hustle" or a hobby that happens to earn some income, this may not apply to you. Creative Freedom is focused on helping creative entrepreneurs build a full-fledged business that's healthy, profitable, and sustainable. The Six Figure Imperative is meant for any Noble Empire that's designed to pay you a living wage and stand on its own. That means you don't need to prop it up by pumping your own money into it all the time, and you're not running it down to zero to keep your personal bills paid. You don't need a job to keep it afloat because it swims on its own.

That doesn't mean that your hobby can't make six figures. It doesn't mean you have to quit your day job to do what you love. There are many stories of creatives that have a day job that pays the bills so that they can create on their own terms. Jim Henson started life that way. But at some point, he decided that being a creative entrepreneur was his path, and he built a company that paid him well - and was able to feed and clothe an army of employees to boot. You dream may not be as grand as Henson's was, but The Six-Figure Imperative can help set you on the path for healthy growth, whatever size your company may be.

===

If you're ready to set your own Six-Figure Imperative, and grow your creative business in a sustainable way, the doors are open to my new Portable Coaching program. If you need start up money, we recommend qvcredit as our legal money lender Singapore. They are tuned in for tech and innovation start ups. Designed for creative entrepreneurs in the start-up phase of growth, Portable Coaching is an easy, affordable way to get the help you need to grow your business. Beyond early start-up? I also have two openings for one-on-one advising. These spots fill fast, so check it out today if you're curious!

At this point in the new year, more than 25% of Americans have already given up on our New Year's resolutions -that is, if we even made them in the first place. By the end of the month, that number climbs to nearly 35% of Americans (more resolution-related stats here).

Some folks (and businesses) are just getting started. I'm still seeing people offering courses on setting up your budget and/or income plan for 2015... that don't start until February!

I hate to break it to you, but you can't get a "jump start" on 2015 if the year is already rolling along!

One of the common problems I see for entrepreneurs stems from income or revenue planning. In fact, if your business is new (less than 5 years old, or making a market transition in the past 2 years), it's not always easy to predict where the money's going to come from in your business.

For many entrepreneurs, the first couple of years feel like throwing spaghetti on the wall to see what will stick. You make offers, do some research, hone your product or service, make more offers, and see who bites. You keep what sells, and table the rest. Sometimes you resurrect that stuff, and sometimes it's gone forever. In my own business, I've had a resurgence of interest in products that I wasn't actively promoting. I had essentially tabled these offerings, so I didn't include them in my revenue planning for this year.

Big mistake. If you've got an offering available, it should always be included in your revenue plan - even if you don't sell many of them during the year.

That got me to thinking about other mistakes I've seen when it comes to planning out your income, so I figured I'd conjure a post to help save you from making the same mistakes in your business.

Mistake #1: Confusing your budget with your income plan

Your budget and your income plan are not the same thing. Because a lot of creative types feel hemmed in by the word "budget" it's become common for coaches and trainers to use a different word (abundance plan, income plan, spending plan, etc.). A budget tells you how you project you'll spend/invest the money you earn. The income plan tells you how you project you'll earn the money in the first place.

I remember one of my early years in business, I created a budget with roughly $50,000 in line item expenses. I had no income plan. Sure enough, about two months into the year, I was pulling my hair out because the income wasn't keeping up with the expenses. I had no idea HOW I was going to earn the money, I had just put down the income of my dreams with no real plan of attack on how to make that income happen. In short order, I quickly reduced my "budget" to align with the realities of the income of my business.

Budgets are often wishful thinking. Income planning is where the rubber meets the road. If you can't figure out how to earn the income, you shouldn't be creating a budget to spend money you don't have.

Mistake #2: Planning that just "covers" the budget

A direct sales client of mine was struggling to get ahead of the curve in her business. She had come to me with an income plan that included very tight margins and little "wiggle room" in case something happened.

Of course, something happened, and her husband was unable to work for an extended period of time. She was panicking about how to make ends meet. After she took a breath, we looked at where she could leverage her existing offers, find better clients and increase her average ticket sale. Then, I illustrated the need to plan for more than just "the minimums" because there's always something for which you can't possibly plan.

Rates go up and "life happens" - yet time and again I see entrepreneurs build a budget and project income based on that budget, without any realistic expectations around the "what if" scenarios of business. What if your current supplier dries up? What if your web host goes out of business or raises their rates in order to stay in business? Most companies give you a 30-day lead time on rate increases, which means you could get hit at the worst possible time of the year if you're not prepared.

Mistake #3: Relying too much on a single income source

One of my previous clients relied heavily each year on the income from one particular offering. Last year, they found themselves scrambling for most of the year to make up for the lost income when they had fewer enrollments than they budgeted for. It wasn't really "lost" income, though, because they never had it to lose! They had put too much reliance on a single source of income. It came back to bite them when they didn't have a plan in place to generate more income with some of their other offerings.

One of my previous clients relied heavily each year on the income from one particular offering. Last year, they found themselves scrambling for most of the year to make up for the lost income when they had fewer enrollments than they budgeted for. It wasn't really "lost" income, though, because they never had it to lose! They had put too much reliance on a single source of income. It came back to bite them when they didn't have a plan in place to generate more income with some of their other offerings.

If this is your first year in business, then it makes sense to focus on one thing, get really good at it, and sell the heck out of it. But once you've been working with clients, listening to customers (you are listening to them, right?), and doing your research, you'll see other offers that you can provide to some if not all of your market. Facebook started as a connecting point for college grads (of particular schools), and only after they got good at that did they expand. Now, they've got Instagram, partnered with Google for advertising, and have their fingers in a bunch of pies. That doesn't mean you have to offer auto parts and jewelry (like Murrays Discount Auto Stores used to). If you're seeing an opening to serve your clients (and you are looking, right?), then it's more than likely you'll have more than one source of income over the years.

What if what you're doing today becomes illegal tomorrow? How can you shift and remain profitable?

This year's VAT regulations for international buyers created a firestorm of resistance, but it still went through. And international vendors of digital goods have to deal with the fallout - at a price. If all your eggs are in one basket and that basket is locked down, you're not in business anymore. On the other hand, if you've got more than one source of income, you'll stand a better chance of weathering the storm (I'm moving my "digital only" products to a platform that handles the VAT for me so I don't have to deal with it).

Mistake #4: Not planning for professional development or support

Technically, this could be construed as a budget item, but the reality is that I see a lot of entrepreneurs planning to make all kinds of money, without any kind of support behind it - whether that's a coach, learning a new skill set, or some other type of professional development. Your budget needs to include these items and so does your income plan. As you scale, costs change. You may hire a VA to handle things that you used to do yourself. If you're planning on earning more than six figured, you can pretty much guarantee that you'll need some kind of support. Your income plan needs to cover the costs of that support. Don't assume that you'll be able to cover it with the growth of the business, because, as I've already said "life happens" and you may find yourself in need before the cash-flow comes in to support it. Which brings me to mistake #5.

Technically, this could be construed as a budget item, but the reality is that I see a lot of entrepreneurs planning to make all kinds of money, without any kind of support behind it - whether that's a coach, learning a new skill set, or some other type of professional development. Your budget needs to include these items and so does your income plan. As you scale, costs change. You may hire a VA to handle things that you used to do yourself. If you're planning on earning more than six figured, you can pretty much guarantee that you'll need some kind of support. Your income plan needs to cover the costs of that support. Don't assume that you'll be able to cover it with the growth of the business, because, as I've already said "life happens" and you may find yourself in need before the cash-flow comes in to support it. Which brings me to mistake #5.

Mistake #5: Not planning for savings (or your own salary)

I can't tell you how many entrepreneurs I've talked to that tell me they made "six figures" in the last year - only to find out the company may have taken in six figures, but they didn't pay themselves a salary.

I can't tell you how many entrepreneurs I've talked to that tell me they made "six figures" in the last year - only to find out the company may have taken in six figures, but they didn't pay themselves a salary.

Say what?

That means that not only did YOU not make six figures, but the company probably didn't either! There's a difference between income and profit. And no, your salary is not profit. If you're not paying yourself, then you're lying to yourself about the actual profitability (and viability) of your business.

You can bet that Donald Trump, Warren Buffett, and Oprah don't work for free. They have large businesses and each draw a salary that's part of the company expenses. Profit is money that's not allocated to covering expenses. Most businesses erroneously think profit is what's left over after covering expenses. I'll show you why that's wrong in a minute. Regardless, you need to be sure that your income plan is built to cover a salary and savings for emergencies.

Financial guru Dave Ramsey reminds us that it's not a question of if, but when emergencies will happen. The printer dies, the laptop gets dropped, the external hard drive crashes... and those are just the minor emergencies. If your income plan (and yes, budget) doesn't include a line-item for savings, you'll find yourself scrambling. What if your tax bill's higher than you budgeted? That's where savings can be a blessing.

Mistake #6: No profit plan

Regardless of what you sell - or how much of it gets sold - it's imperative that you have a profit plan. If you sell even 20 cents worth of products or services this year, you need a plan in place to ensure that your company derives a profit.

Okay, twenty cents might be a little ridiculous, but maybe not.

Mike Michalowicz, author of "Profit First" says that profit needs to be a habit - not an event - in your business. Instead of making profit an afterthought (profit = income - expenses, like most businesses expect), Mike says pay your business first and set aside a portion of your income so that you always have profit in the business. I recently led a webcast to explain the Profit First approach and help you get a handle on making sure your business is always profitable.

Whether or not you come to the webinar, it's important to see profit with fresh eyes. You don't have to build your business on the "leftovers" - which, if you're anything like most entrepreneurs I know, there aren't many leftovers to begin with. Instead, you can make an intentional step toward building a solid profit plan - and income plan (and budget) - that's built realistically around what you need to accomplish in the next 12 months (and beyond).

What mistakes have you made?

I'd love to hear what mistakes you've made in your budgeting/income planning process. What did you learn and how did you recover? Let's learn from one another in the comments!

As I hear clients, colleagues, and friends sharing their goals for 2015, there's a chorus being repeated over and over:

"This year is the year I FINALLY break __ figures!"

I've heard it so many times that it makes me dizzy and sad to think about the number of folks who continue to miss the mark on this particular goal each year. When I ask why they haven't hit their goal yet, I hear lots of "reasons" - but ultimately, those reasons all mask the truth of why they really haven't hit their big income goal - whatever it is.

I've heard it so many times that it makes me dizzy and sad to think about the number of folks who continue to miss the mark on this particular goal each year. When I ask why they haven't hit their goal yet, I hear lots of "reasons" - but ultimately, those reasons all mask the truth of why they really haven't hit their big income goal - whatever it is.

First a warning: "Big income goal" is relative. Like dream shame, the fact that you have a goal means it's big. For you, it might be 10 figures, or 6, or 5, or being able to finally quit the day job. The number doesn't matter. The principles are the same regardless of the number of zeroes at the end of the figure.

Why is it that most entrepreneurs that dream of making "mucho dinero" don't hit their big income goal? Here are a few reasons I've encountered (both on my own journey, as well as with my clients): (more…)

What does it really mean to be profitable?

With my newly-minted certification as a Profit First Professional coach (huzzah!), I've spent more than a few hours thinking about this question.

Profit First is a concept (and now a book) penned by business author (and my friend) Mike Michalowicz. The book drives home the point that most business owners make profitability an event (or worse, an afterthought), rather than a habit. Mike says "Shouldn't your profit come first?"

Um. Yes.

In fact, even a "for-purpose organization" (a term my friend Doug uses for non-profits) needs to generate positive cash flow in order to be sustainable.

Yet, so often, people bent on making a positive difference in the world think that focusing on profits is "icky".

*breathe*

There's a good reason for the ick. It stems from a very dismpowering definition of the word "profit". Let me explain...

Profit 1.0

Here's how we typically define "profit" today - courtesy of our friends at Google. The idea of "more" for the sake of more can leave heart-centered entrepreneurs feeling icky. We're not trying to get "more" all the time - especially not at the expense of people. Neither are trying to take advantage of others - or be taken advantage of ourselves! Yet the top two definitions of the word "profit" relate specifically to those two concepts:

For most of us, the word "profit" is synonymous with the word "money". They think about "rakin' in the dolla bills" and then rolling around in a pile of money like Scrooge McDuck. It's the "bottom line" of the balance sheet. It's the account balance, the number that's left at the end of the month when all the bills are paid - and before the next bill comes due.

Evil empires have hoarded it, conquered for it, and some companies have been built to focus on it (and only it) relentlessly.

No wonder we get all icky inside just thinking about it. After all, we're here to make a difference, to make a positive impact on the world. We want to make people happy, bring them joy, ease their pain, and we put the welfare of people ahead of money money.

We want to do good things, and all that ick, can't be good, can it?

We get mixed messages: loving money is the root of all evil, yet it makes the world go 'round.

Ah money, why do you vex us so?

What if profit had a wider, more holistic definition? Or is that too much of a stretch for you?

(more…) This is my second appearance on Mike Michalowicz's popular show. He's a funny guy, and his co-hosts keep things hopping. Mike's the guy who wrote The Toilet Paper Entrepreneur, The Pumpkin Plan, Surge, and, yes, Profit First. His new book, Clockwork will be out this fall.

This is my second appearance on Mike Michalowicz's popular show. He's a funny guy, and his co-hosts keep things hopping. Mike's the guy who wrote The Toilet Paper Entrepreneur, The Pumpkin Plan, Surge, and, yes, Profit First. His new book, Clockwork will be out this fall. This was my first (and hopefully NOT last) appearance on The Strategy Hour with Abagail and Emylee. These two are a powerhouse combination of business smarts and compassion for the creative entrepreneur's lifestyle. We talk about the importance of striving for a six-figure business - or not, and the rare reasons why you may not need to aim that high. We also dig into the Cusp types - something I don't get to do very often when talking about the Creative Entrepreneur Type Spectrum. If you're a cuspy, this could be some great learning for you.

This was my first (and hopefully NOT last) appearance on The Strategy Hour with Abagail and Emylee. These two are a powerhouse combination of business smarts and compassion for the creative entrepreneur's lifestyle. We talk about the importance of striving for a six-figure business - or not, and the rare reasons why you may not need to aim that high. We also dig into the Cusp types - something I don't get to do very often when talking about the Creative Entrepreneur Type Spectrum. If you're a cuspy, this could be some great learning for you. I love me some Charlie Gilkey! I was lucky enough to be a guest just as the Creative Freedom Spectrum was coming into the world, so when they asked me back as a contributor, I was thrilled!

I love me some Charlie Gilkey! I was lucky enough to be a guest just as the Creative Freedom Spectrum was coming into the world, so when they asked me back as a contributor, I was thrilled!

Share your thoughts and ideas in the comments. Your insights may spark a conversation that helps someone else!

Share your thoughts and ideas in the comments. Your insights may spark a conversation that helps someone else!

One of my previous clients relied heavily each year on the income from one particular offering. Last year, they found themselves scrambling for most of the year to make up for the lost income when they had fewer enrollments than they budgeted for. It wasn't really "lost" income, though, because they never had it to lose! They had put too much reliance on a single source of income. It came back to bite them when they didn't have a plan in place to generate more income with some of their other offerings.

One of my previous clients relied heavily each year on the income from one particular offering. Last year, they found themselves scrambling for most of the year to make up for the lost income when they had fewer enrollments than they budgeted for. It wasn't really "lost" income, though, because they never had it to lose! They had put too much reliance on a single source of income. It came back to bite them when they didn't have a plan in place to generate more income with some of their other offerings. Technically, this could be construed as a budget item, but the reality is that I see a lot of entrepreneurs planning to make all kinds of money, without any kind of support behind it - whether that's a coach, learning a new skill set, or some other type of professional development. Your budget needs to include these items and so does your income plan. As you scale, costs change. You may hire a VA to handle things that you used to do yourself. If you're planning on earning more than six figured, you can pretty much guarantee that you'll need some kind of support. Your income plan needs to cover the costs of that support. Don't assume that you'll be able to cover it with the growth of the business, because, as I've already said "life happens" and you may find yourself in need before the cash-flow comes in to support it. Which brings me to mistake #5.

Technically, this could be construed as a budget item, but the reality is that I see a lot of entrepreneurs planning to make all kinds of money, without any kind of support behind it - whether that's a coach, learning a new skill set, or some other type of professional development. Your budget needs to include these items and so does your income plan. As you scale, costs change. You may hire a VA to handle things that you used to do yourself. If you're planning on earning more than six figured, you can pretty much guarantee that you'll need some kind of support. Your income plan needs to cover the costs of that support. Don't assume that you'll be able to cover it with the growth of the business, because, as I've already said "life happens" and you may find yourself in need before the cash-flow comes in to support it. Which brings me to mistake #5. I can't tell you how many entrepreneurs I've talked to that tell me they made "six figures" in the last year - only to find out the company may have taken in six figures, but they didn't pay themselves a salary.

I can't tell you how many entrepreneurs I've talked to that tell me they made "six figures" in the last year - only to find out the company may have taken in six figures, but they didn't pay themselves a salary. I've heard it so many times that it makes me dizzy and sad to think about the number of folks who continue to miss the mark on this particular goal each year. When I ask why they haven't hit their goal yet, I hear lots of "reasons" - but ultimately, those reasons all mask the truth of why they really haven't hit their big income goal - whatever it is.

I've heard it so many times that it makes me dizzy and sad to think about the number of folks who continue to miss the mark on this particular goal each year. When I ask why they haven't hit their goal yet, I hear lots of "reasons" - but ultimately, those reasons all mask the truth of why they really haven't hit their big income goal - whatever it is.